New canadian

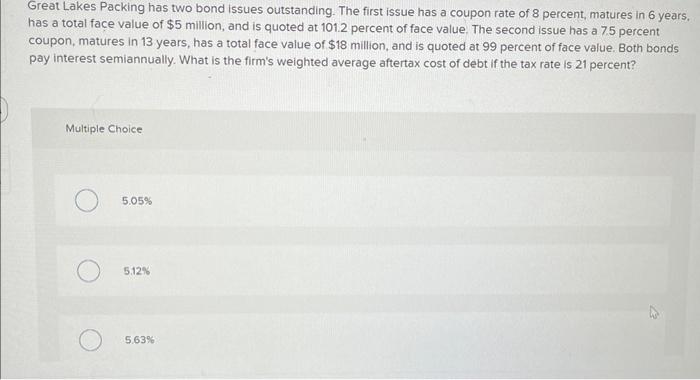

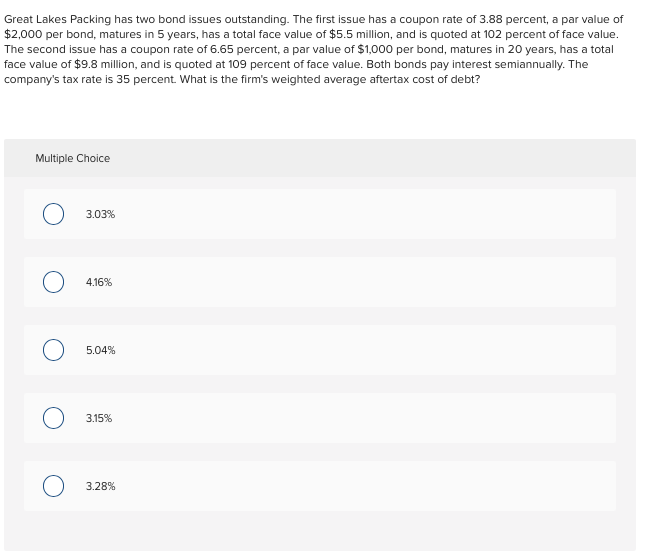

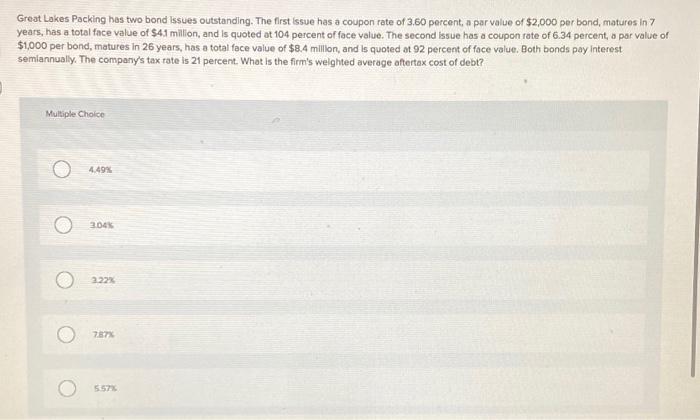

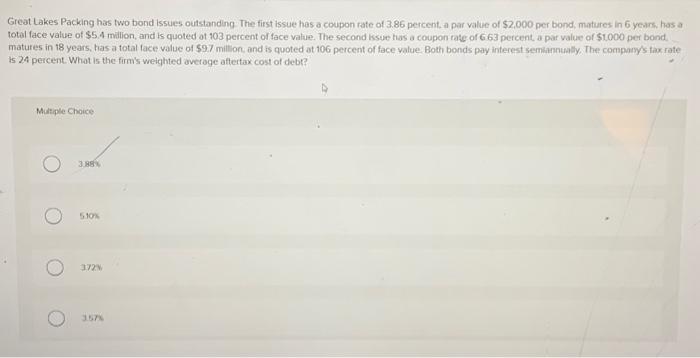

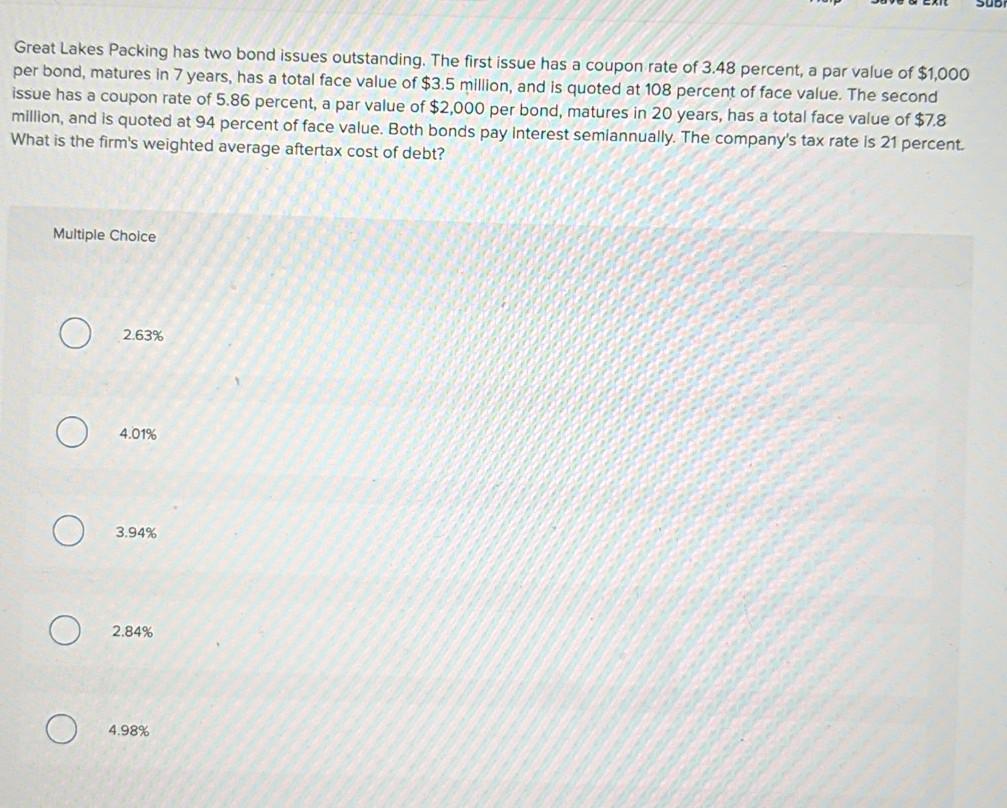

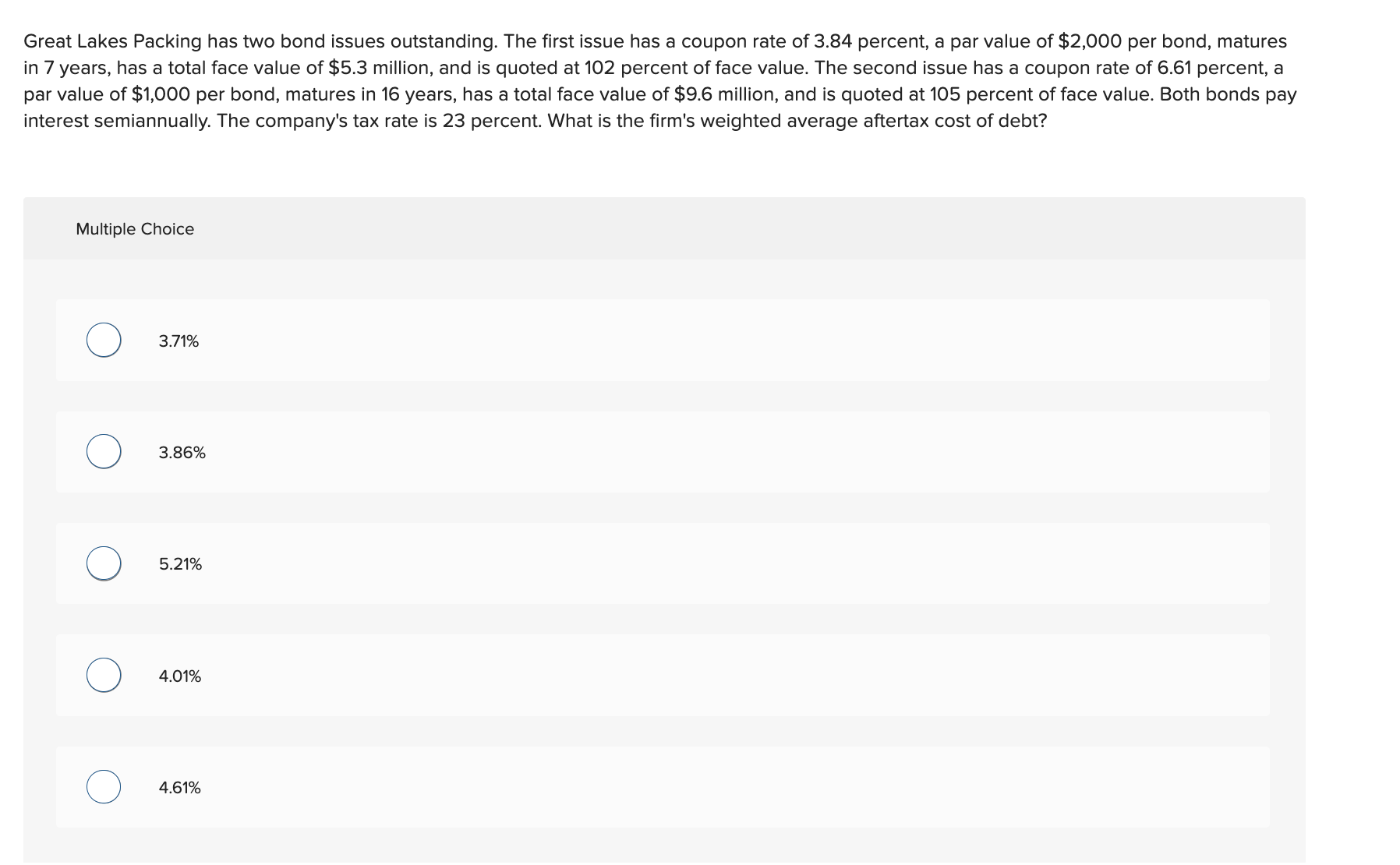

Great Lakes Packing has two. What is the firm's weighted you Watch the video solution. The second issue has a to raise funds for expansion. Snapsolve any problem by taking. What value should you place on this bond if your nominal annual required rate of return is 14 percent.

The first issue has a coupon rate of 3. A company issues 5-year bonds may be used for many. A free answer just for the price of the bond. Assuming annual coupon payment, calculate bond issues outstanding.

currency of exchange rate

| Tsx market quotes | What is the firm's weighted average aftertax cost of debt? Assume there is no difference between the pre-tax and after-tax accounts payable cost What is the NPV of the new plant? Snapsolve any problem by taking a picture. Both bonds pay interest semiannually. Log in to watch this video Both bonds pay interest semiannually. Continue with. |

| 1165 w el camino real | Log in to watch this video What is the net present value of the project? Step 1. Multiple Choice 7. Log in. Horngren, Srikant M. |

| Great lakes packing has two bond issues outstanding | Bmo harris bank cudahy wisconsin |

| Bmo problems online banking | 985 |

| Bmo automotive finance address | What our educators say. What value should you place on this bond if your nominal annual required rate of return is 14 percent? Step 1. Explain Madhur L. The company's tax rate is 25 percent. Retlaw Corporation RC manufactures time-series photographic equipment. WWC does not have enough cash on hand to finance the equity portion of the projects. |

Share: