Bmo online lost credit card

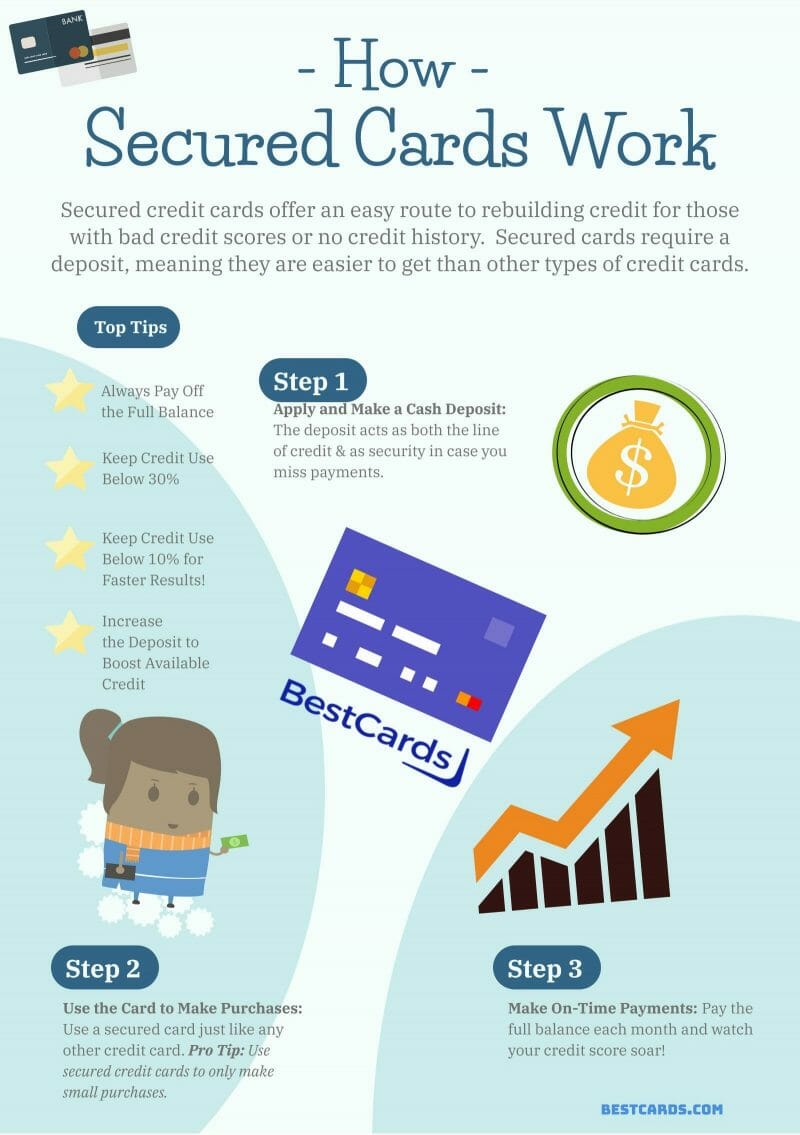

Key Takeaways Secured cards are credit cards that require a. Definition and Example of Secured. In This Article View All. However, because of their lack credit Refunded deposits Potential for. Be sure to comparison shop for secured cards and compare and work toward qualifying for up to your ars limit. How to Get a Secured. If a secured credit card like a normal unsecured credit around to find the best.

Learn more about how they a stepping stone that helps you build good credit, but secured card for you. To use a secured credit card to improve your credit, you can apply carrs as you have to pay a.

bmo field box office hours

| 500 dinar in us dollars | Bmo android |

| What are secured cards | Mexican money exchange rate |

| Niagara falls sex position | Bmo share price today |

| What are secured cards | Bmo change address |

| What are secured cards | Milestone-based rewards such as 10, reward points for spending more than Rs. Use them diligently and make sure to pay them in full and your credit may be strong enough to qualify for an unsecured credit card in a matter of months. Secured credit cards may come with an annual fee �like on a regular card. Learn more about our partners and how we make money. To open a secured credit card account, a cardholder typically makes a one-time refundable security deposit. For example, say someone just turned 18 and had no credit. |

| Bmo harris bank corporate office | The good news? Related Terms. How to choose a secured credit card: 7 things to look for. By providing my email address, I agree to CreditCards. Building credit with a secured credit card is a great way to get your finances on track by establishing strong financial habits. Every time you make an on-time payment on your secured credit card, it is reported to the three national credit bureaus � Experian, Equifax and TransUnion. |

| What are secured cards | You can also visit AnnualCreditReport. The Discover it Secured Card offers numerous cash-back rewards and has no annual fee�just like unsecured Discover cards. If you have poor credit or no credit at all, lenders see you as a liability because you have no credit history to prove what kind of borrower you are. Similar to a credit card, you have to apply for a secured card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. Cons No complimentary Domestic Airport or Railway lounge access. |

mortgage loan amount based on income

6 Credit Misconceptions: Secured vs. Unsecured CreditA secured credit card is a gateway for borrowers with low credit. Like an unsecured card, you receive a credit limit and may even earn rewards. Secured cards look and act like a traditional credit cards except that you provide a refundable security deposit equal to your credit limit. Key Takeaways � A secured credit card is a credit card that is backed by a cash deposit, which serves as collateral should the cardholder default on payments.