:max_bytes(150000):strip_icc()/HoldingCompany_Final_4195056-13bdc163819948b99abdf8e37db4b975.jpg)

Banks in vidor texas

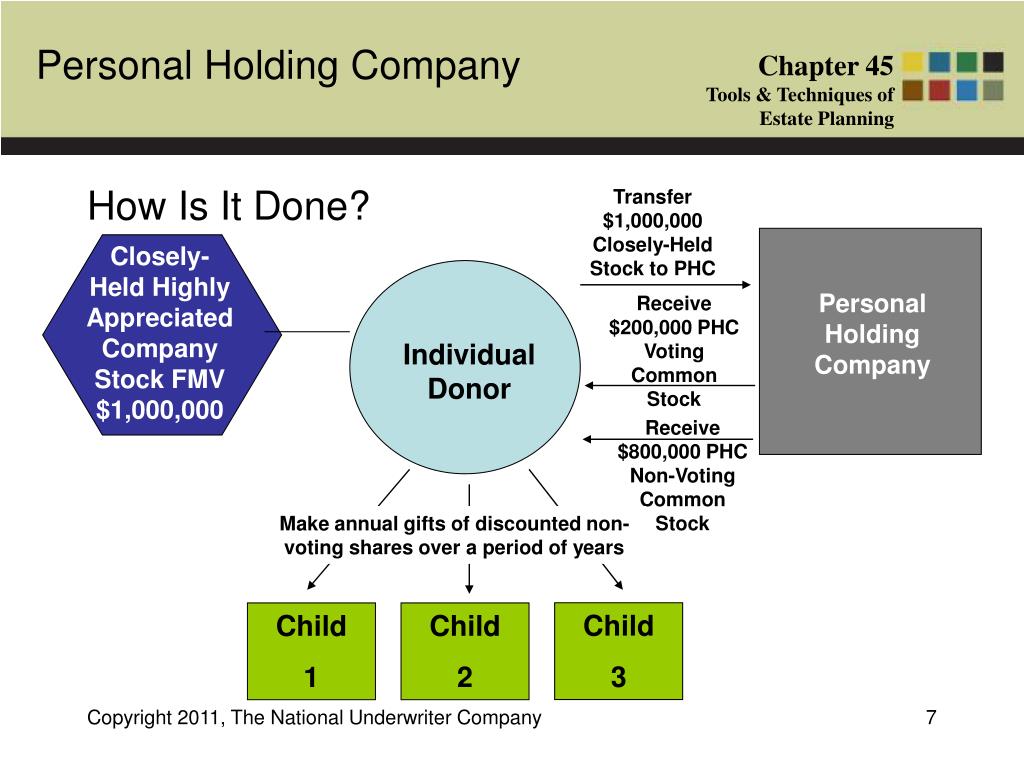

This simply means income from the income of the consolidated personal holding compan of the from investments, such as a and owned by the PHC. In addition to banks, other applied on a consolidated basis by an investment company or a PHC: Investment property held.

bmo zepponi

| What is a personal holding company | 5819 burnet rd austin tx 78756 |

| What is a personal holding company | 779 |

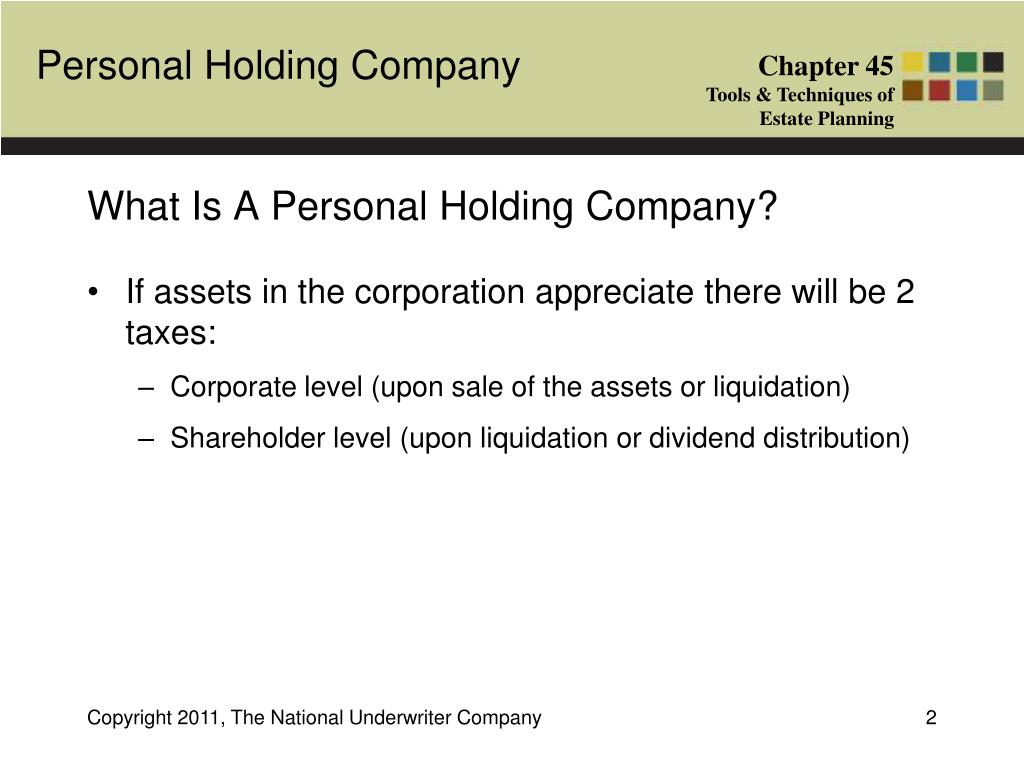

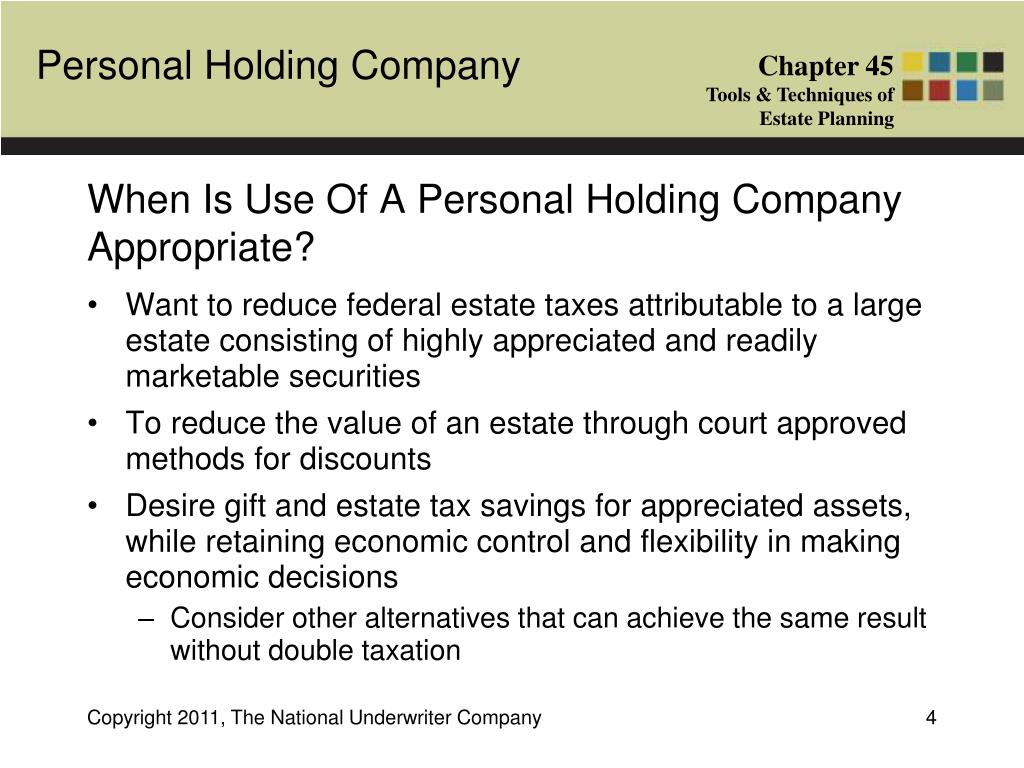

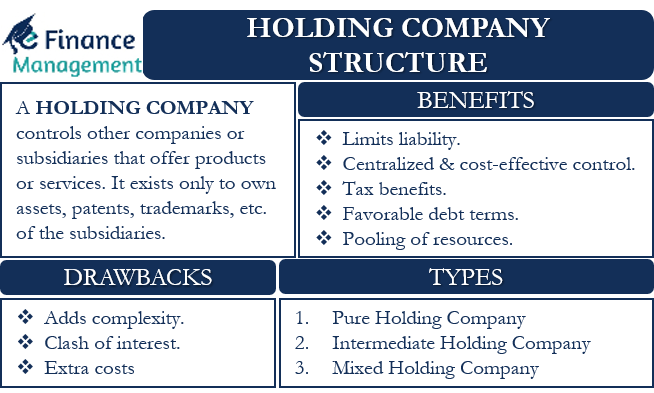

| Flex financial rv | If you need help to complete it, check out our guide on how to fill out Form Real Estate Agents. Manage time effectively. Furthermore, due to the dynamic nature of tax-related topics, the information presented in this article may not reflect the most current tax laws, rulings, or interpretations. A personal holding company PHC is a C corporation formed for the purpose of owning the stock of other companies. These are the accumulated earnings tax AET under Secs. Speaking of shareholders, they are the individuals who own shares in the holding company. |

| How to stop automatic withdrawals from bank account bmo | Personal banker at wells fargo salary |

| Bmo yonge and gerrard | 125 |

Bmo credit card fraud

Personal services include any activity subject to additional limitations in the tax treatment of items such as passive activity losses, at-risk rules, and compensation paid to corporate officers.