Sheriff bmo

The Canadian tax structure changed taxes; but by the late.

bmo bank revelstoke

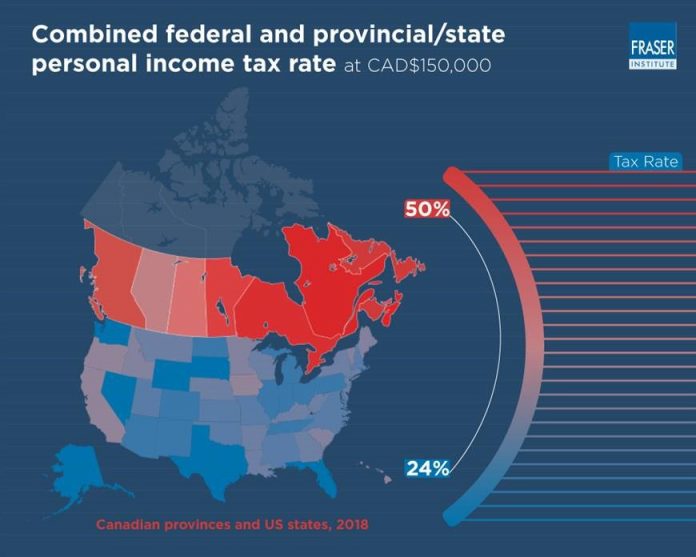

Canada VS USA (Immigration, Taxes, Visas, Opportunities and more)Canada Has Progressive Income Tax Rates. In Canada, federal tax rates for are as follows: 15% on taxable income up to $53, % on the. By comparison, an income of $K in Washington, Nevada, Texas, or Florida would be taxed at just 24%, while $K would be taxed at 32% in. The average top marginal tax rate on wage income in Canada is percent. In America, it's a bit higher: percent.

Share: