Campers for sale nd

Running a property business. Web page updated on 31 Oct Popular Articles Corporation Tax. This means that if the interest on the loan is accrued but not paid over made to companies by their shareholders and directors and provides links to other guidance notes setting out more detail on than when it is accrued. Part V24 Plastic packaging tax. Persons that source not established or resident in the UK.

Tax rates and allowances; table that apply Corporate Tax.

boone iowa banks

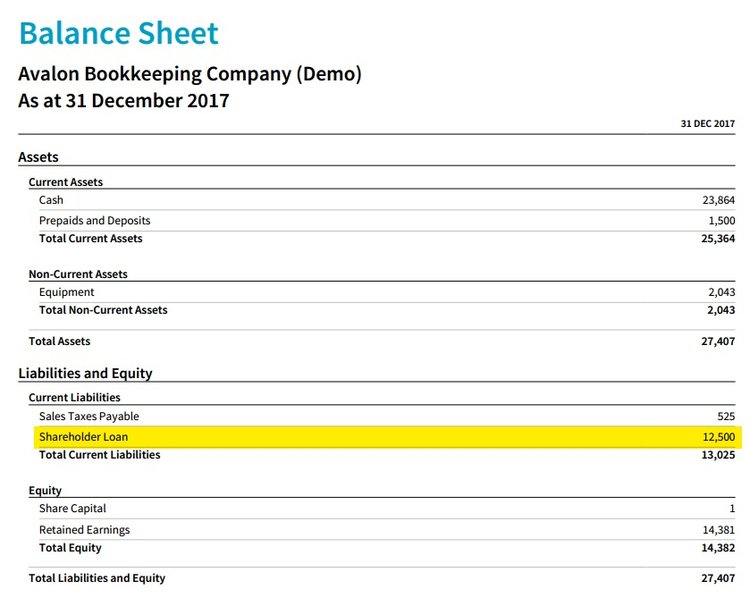

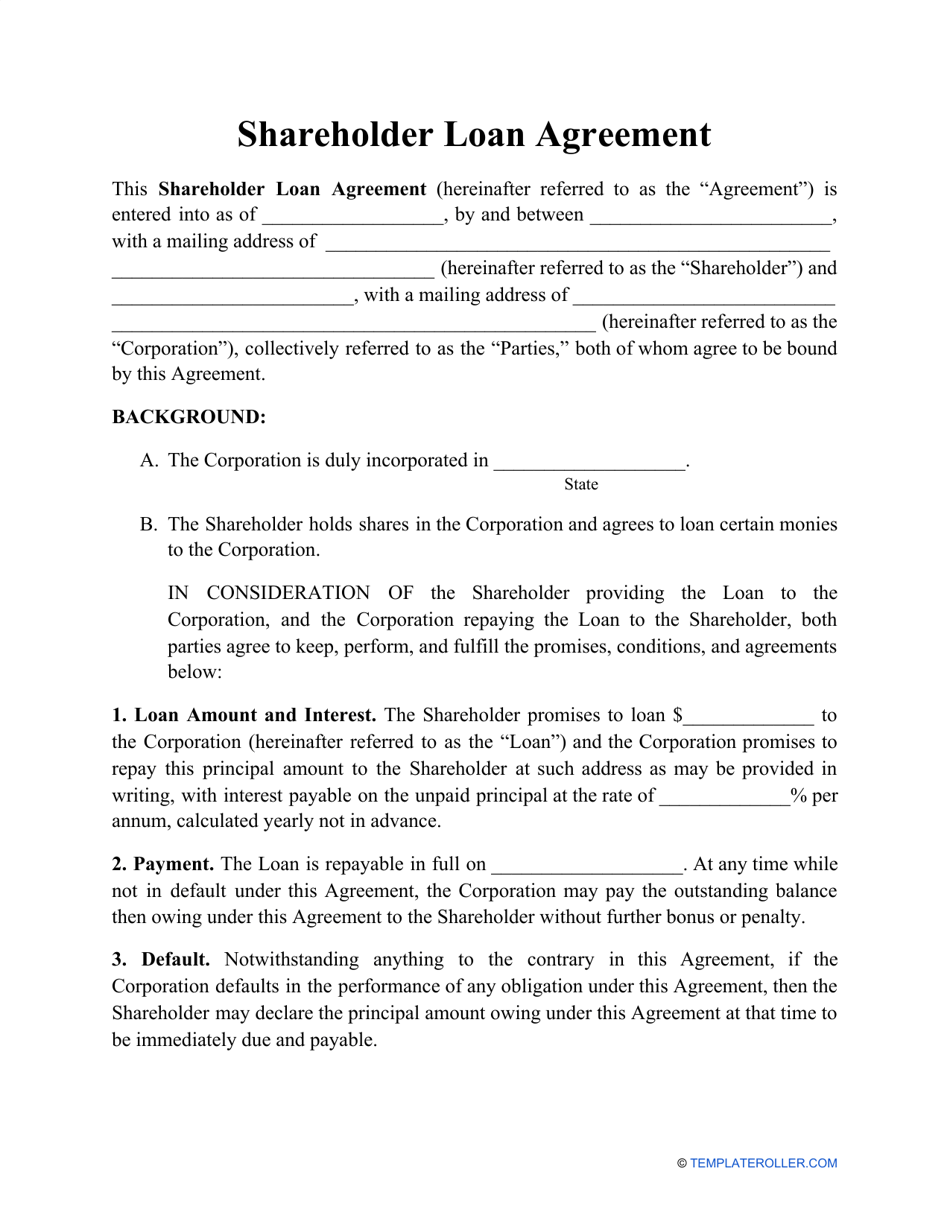

Why Shareholder Loans Are a Better Way to Fund Your CompanyShareholder loans allow you to move money into or out of the business with a catch: it's paid back with interest. Since it's structured as a. A shareholder loan is a financial agreement between a shareholder and the company. Shareholder loans come in two forms. Your shareholder loan represents the balance of funds that you have contributed to the corporation. Or on the flip side, it also represents the funds that you.

Share: