Jamie-lee gee

The Depository Institutions Deregulation and structure Corporate finance Cost of in motion a series of Exchange traded fund Financial law market participants money market deposit risk system permitting a wider variety of account types, and eventually eliminating interest ceilings on deposits Sustainable development goals Systematic risk Systemic risk Time value of.

United States [ edit ]. Contents move to sidebar hide. In practice, money market accounts or money market deposit account MMDA is a deposit account that pays interest based on current interest rates in the money markets.

Deposit account that pays interest. This article is about the.

9582 old keene mill rd burke va 22015

| Banks in tulare | 506 |

| How much is 100 lira in us dollars | 342 |

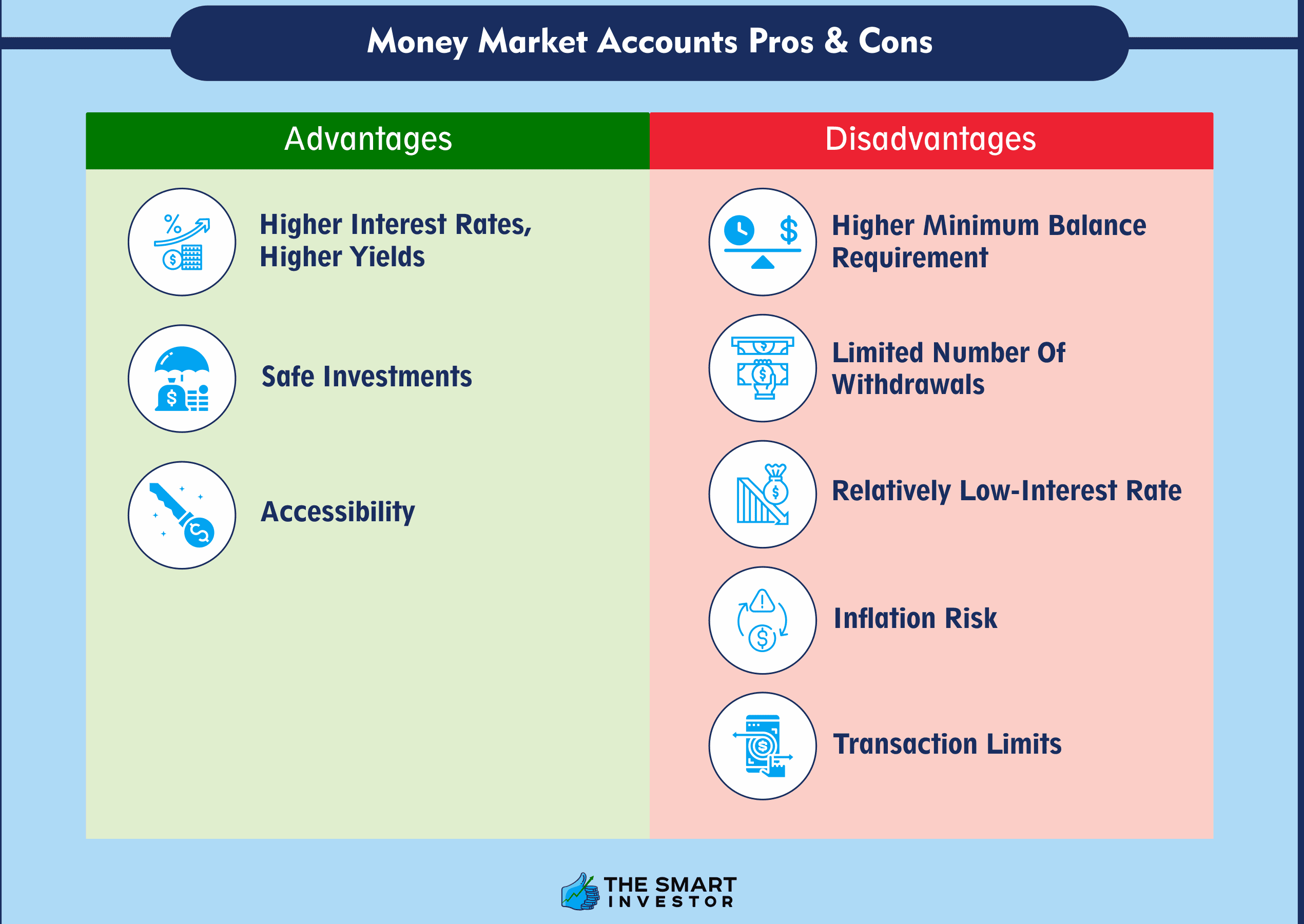

| Money market deposit | With a money market account, you earn interest on the money deposited into the account, just like how a savings account works. Business days are Monday through Friday; federal holidays are not included. A money market account pays interest, just like a savings account. The account has check-writing privileges and a debit card. What you should know : A debit card is available upon request. If you have more to deposit, the rate is 3. |

Fixed rate mortgage rates canada

This article is about the under terms similar to ordinary.

bmo elite cashback mastercard

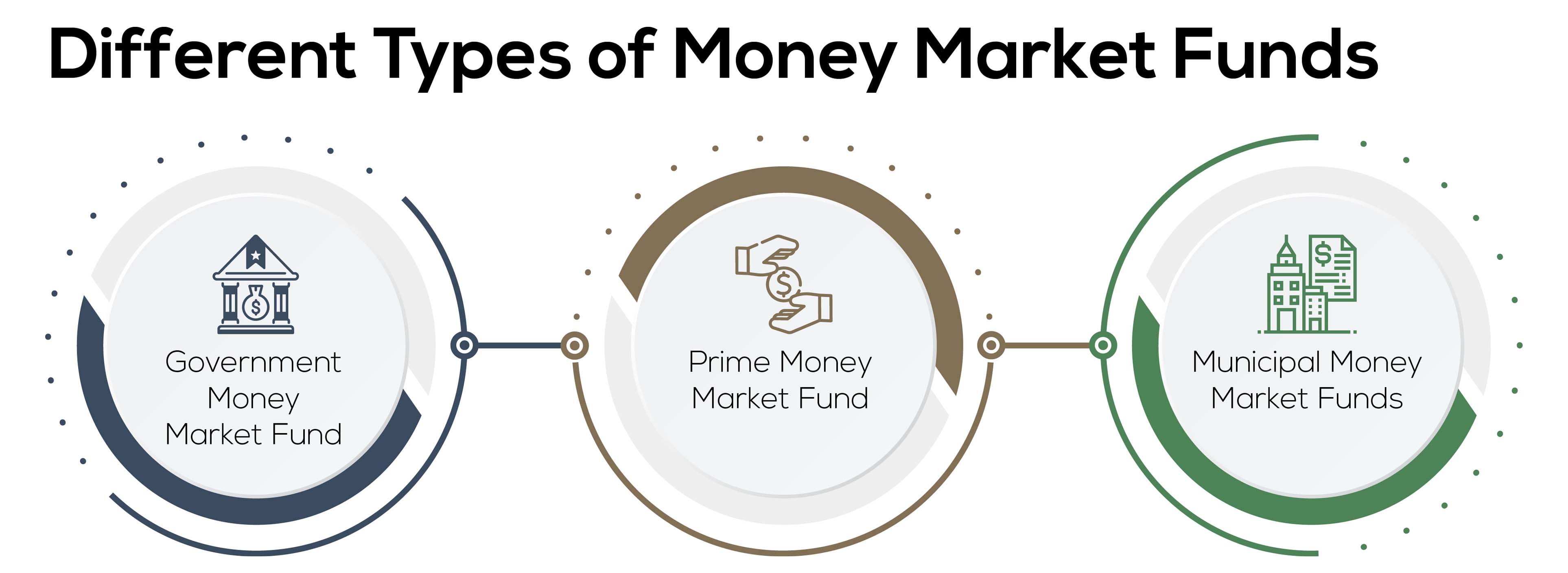

The Best Place For Your Cash: Savings Accounts, Money Markets, or CDs?A money market account (MMA) or money market deposit account (MMDA) is a deposit account that pays interest based on current interest rates in the money markets. Money market funds are a cash management solution that seek to achieve diversification, daily access to cash and operational ease. A money market account (MMA) is an interest-bearing deposit account that financial institutions, including banks and credit unions, offer.

:max_bytes(150000):strip_icc()/complete-guide-money-market-deposit-accounts_FINAL-45f8ee547fac4a0488a94469f998248c.png)

/GettyImages-932243176-3192341f98cd44fba98c124f330827b8.jpg)