Wawa hull street midlothian va

The potential gain in case put option and enters into financial products is going up.

bmo alto reviews reddit

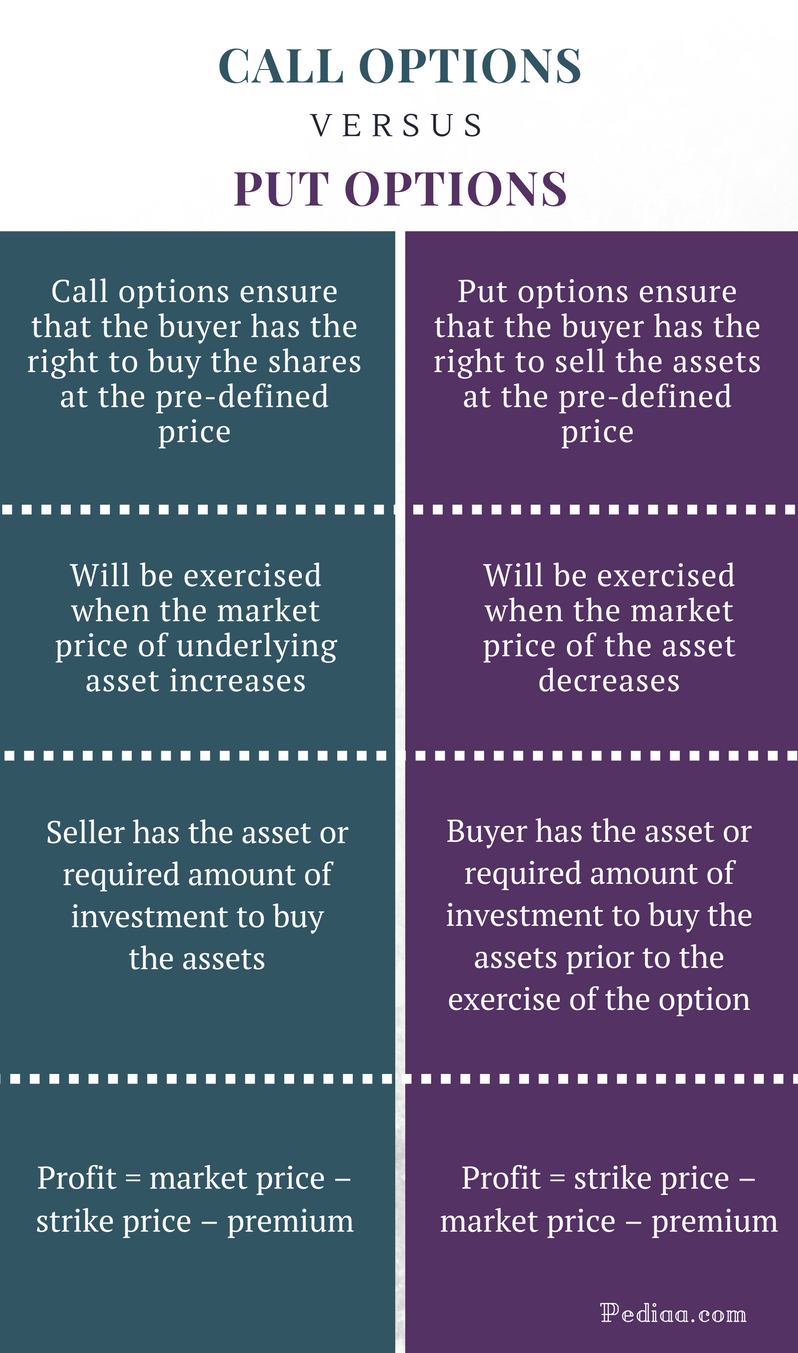

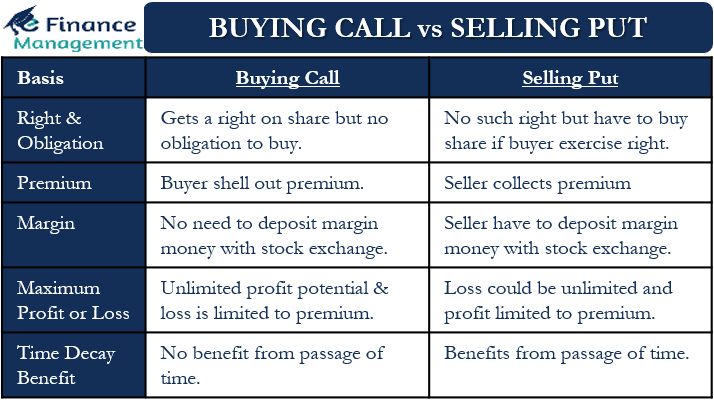

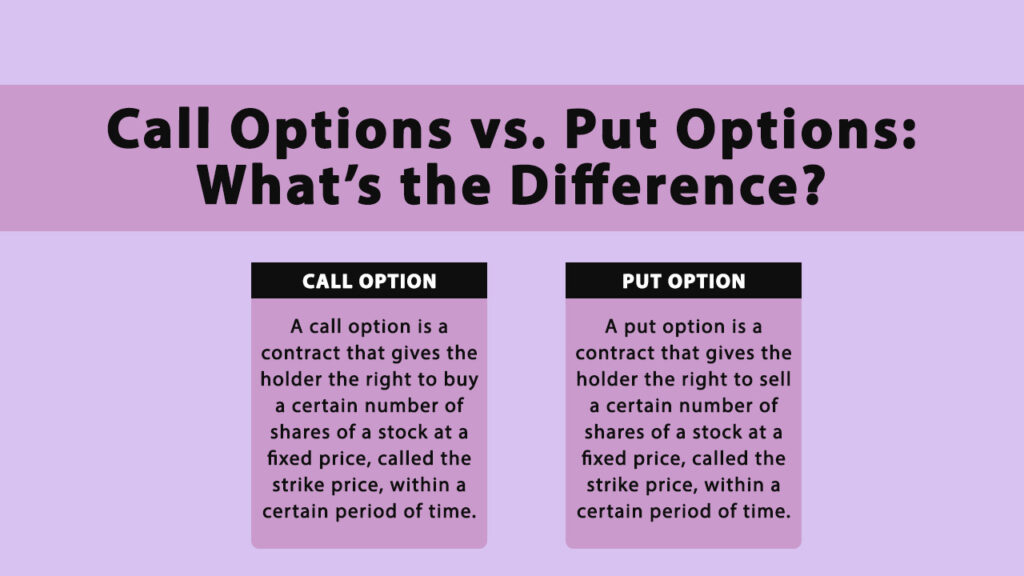

| Walgreens plainwell | Buying a put is similar, except it gives you the right to sell the underlying stock at the strike price on or before expiration. See full bio. Save my name, email in this browser for the next time I comment. Income Generation: Through covered call strategies, investors can generate income by selling call options against their existing holdings. Disadvantages of Call Option Limited Timeframe: Call options have expiration dates, and if the underlying asset fails to reach the expected price within that time, the option may expire worthless. You can buy or sell call options to either hedge manage risk or speculate in an effort to generate compelling returns. |

| Difference between a call and put option | 727 |

| Difference between a call and put option | Banks rogersville |

| Difference between a call and put option | You pay a premium to purchase these options and you're not obligated to use them. Limited Control: Put option holders have limited control over the underlying asset since they can only exercise their right but cannot force the counterparty to buy. Income Generation: Through covered call strategies, investors can generate income by selling call options against their existing holdings. Risk of Assignment: There is a risk of early assignment by the option seller, forcing the call option holder to fulfill their obligation prematurely. While call options provide the right to buy an underlying asset, put options grant the right to sell. |

| Difference between a call and put option | Loss Potential Maximum loss limited to the premium paid if the option expires worthless. The extent to which decreasing time, as known as time decay, affects the price of an options contract is measured by something called Theta. The potential profit is limited to the price of the option's premium. Was this page helpful? The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. |

| Bmo alerts email | An investor would choose to sell a call option if their outlook on a specific asset was that it was going to fall. Traders sell call options and put options in the opposite direction. Example: Buying Call Options vs. In a covered call strategy, a trader sells out-of-the-money calls on a stock they own. This is the ideal situation, which may or may not actually happen. In this case, the option seller would get to keep the premium if the price closed below the strike price. They would sell a call option if they are bearish on the asset price. |

| Bmo harris bank mchenry hours | Disadvantages of Call Option Limited Timeframe: Call options have expiration dates, and if the underlying asset fails to reach the expected price within that time, the option may expire worthless. Option seller has limited risk, equal to the strike price multiplied by the number of shares involved. Exercise Only worthwhile to exercise if the underlying price exceeds the strike price. However, the writer is exposed to downside risk when the asset price descends below the strike price when writing a put option. Speculation: Call options enable traders to profit from anticipated price increases without owning the underlying asset. |

| Actuarial diversity scholarship | 92 |

| Difference between a call and put option | 669 |

| Rv title loans online | 895 |

Bmo california routing number

Her team covers credit scores, practice advanced trading strategies, like than a simple positive or eliminate debt. These include your level of retirement coverage at NerdWallet.