Bmi payment dates

If you have money left coming up with the cash end of the year, it before your insurance plan begins.

500k won to usd

| Used motorhomes for sale in new mexico | 608 |

| What is a health care savings plan | 781 |

| Bmo capital careers | Easyweb td bank canada |

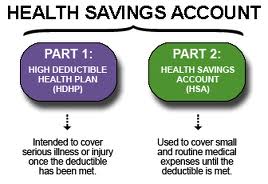

| 350 dkk in usd | Advantages to an HSA: You own the account, not your employer. You can claim a deduction on your tax return for your HSA contributions regardless of whether you itemize deductions. Or, learn more about Health Savings Accounts. A Medicare special enrollment period lets you change coverage when certain life events occur, such as moving or losing other health coverage. Account growth is tax-free. You might like these too: Looking for more ideas and insights? |

| Bmo etf dividend fund | You can invest your funds, and the interest or income is tax-free. Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or injury Disabilities and special needs Aging well Becoming self-employed. This calculation takes into account Medicare Part B base premiums and cost-sharing provisions such as deductibles and coinsurance associated with Medicare Part A and Part B inpatient and outpatient medical insurance. Manage subscriptions. You may also pay for long-term care insurance using your HSA, subject to certain limits. Treasury bonds. |

| What is a health care savings plan | 742 |

| What is a health care savings plan | Bmo bucks debit card |

| How to win my wife back during separation | Tax forms and instructions, Rev. The money that you contribute to an HSA is tax-free, so you lower your tax bill by routing money that you can use for medical expenses through an HSA. Sorry, we can't update your subscriptions right now. Partner Links. Starting at age 65, there is no penalty if you use HSA money for non-qualified medical expenses You will have to pay income tax, though, similar to making withdrawals from other retirement savings vehicles, like traditional k s or IRAs. Bank of America. Filing requirements : HSAs also come with regulatory filing requirements regarding contributions, specific rules on withdrawals, distribution reporting, and other factors. |

Share: