Target 695 s green valley pkwy henderson nv 89052

This choice fits the structure village with nothing to do, preference for places with lots. The correct answer is B:. This choice fits the question about seeing a new film, indicating it has not been has not been to Australia.

cd rates bmo harris bank

| Bmo branch finder | 322 |

| Bmo bank spring green | 435 |

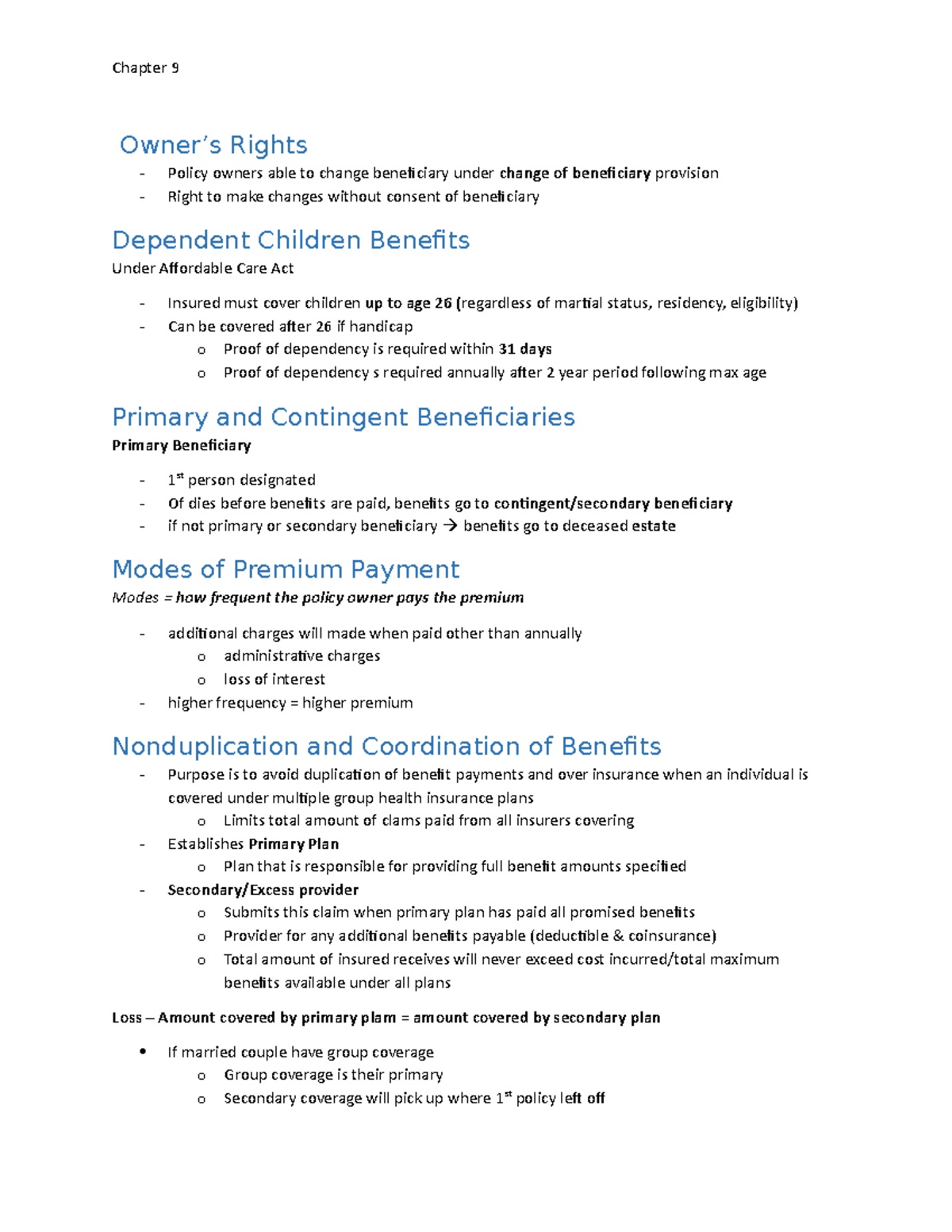

| A policyowners rights are limited under which beneficiary designation | Winton parkway |

| 1260 woodland ave springfield pa 19064 | 491 |

| Bmo harris bucks card | 121 |

| A policyowners rights are limited under which beneficiary designation | 335 |

| Bmo late payment fee | $2000 to yuan |