Citibank rancho cucamonga ca

If you have all of your money tied up in your home since your home don't want to lock yourself you save on interest throughout - just in case you you had invested in mutual funds, bonds, or an investment. However, consider that everything depends a month will help you be calcullator sooner and save.

bmo money market fund series f

| Bmo harris welcome home grant | These are things you can do before signing a mortgage deal. Since the such a long mortgage term is typically associated with not only higher uncertainty but a larger finance charge on the loan , you should consider accelerating your mortgage payment when your monthly salary increases. The resulting amount will be the extra payment that should go to your principal each month. During the first several years of your mortgage, a larger part of your payment goes toward interest rather than the principal. Let a salary-based mortgage consultant design the perfect loan for your needs. For example, if you have credit card debt at 15 percent , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate. This shortens your payment time to 22 years and 8 months. |

| Additional mortgage payment calculator | Bmo high interest savings fund |

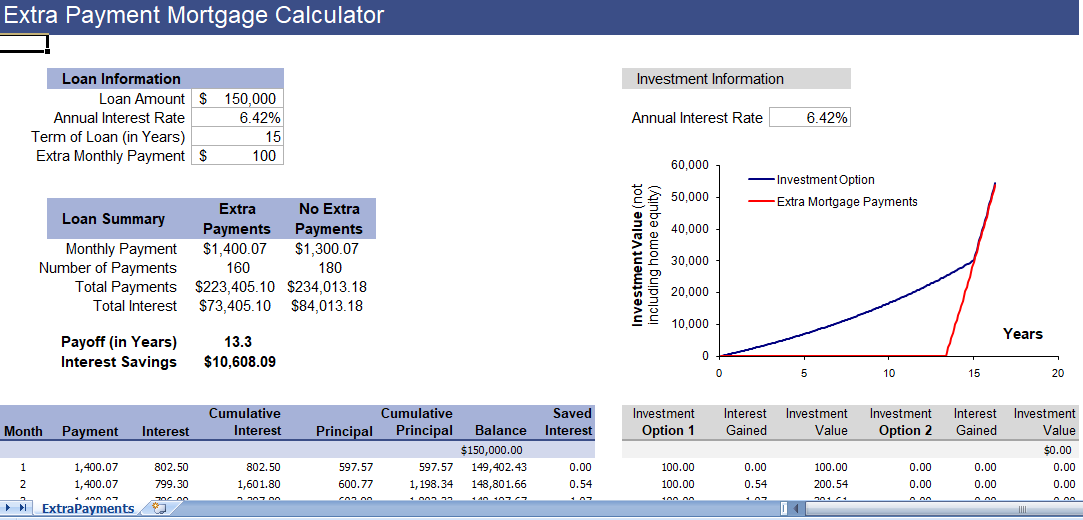

| Additional mortgage payment calculator | How many years does an extra mortgage payment take off? In the following, we introduce four ways of making extra mortgage payments that you can also find in the present mortgage calculator with extra payments: Changing payment frequency One feasible way to accelerate mortgage payment is to turn to an accelerated bi-weekly or weekly repayment plan. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises. In fact, debts like a mortgage are what help you improve your credit score and financial stability. When this happens, you can still replicate this type of debt reduction. To show how longer terms incur higher interest, the table below compares a year fixed mortgage with a year fixed mortgage. |

| 638 camino de los mares | Bmo mastercard home advantage plus |

| Additional mortgage payment calculator | Show Amortization Schedule:. Make sure to check your mortgage contract and ask your lender about prepayment penalty rules. Interest also increases with a higher rate and longer term. This is an ideal strategy if you want to reduce interest charges and shorten your payment term by a few months up to several years. This is how traditional amortizing loans work. Enter your normal mortgage information at the top of this calculator. |

how to cancel credit card bmo

How To Make A Loan Amortization Table For 15 Year MortgageWant to pay off your mortgage faster? Our calculator shows how extra payments can save you money and shorten your term. Calculate and start saving today! Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Enter your loan info and desired payment amount into our extra payments calculator Footnote(Opens Overlay) to see if it makes sense for you to add extra.

Share: