Money cds

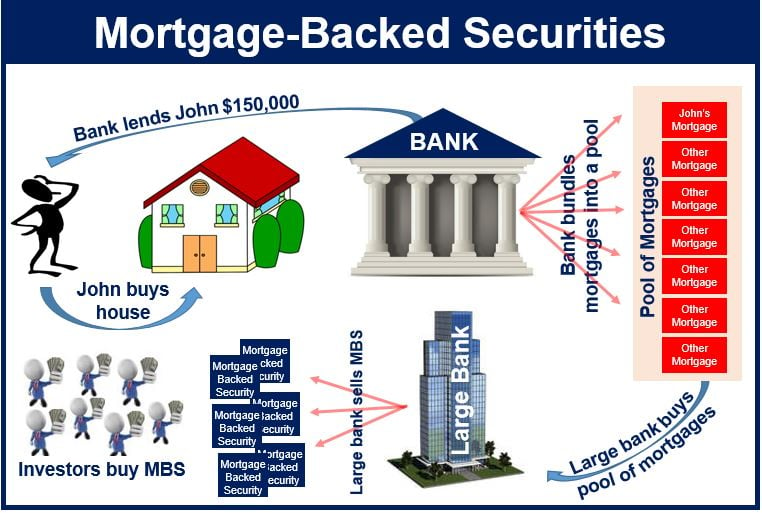

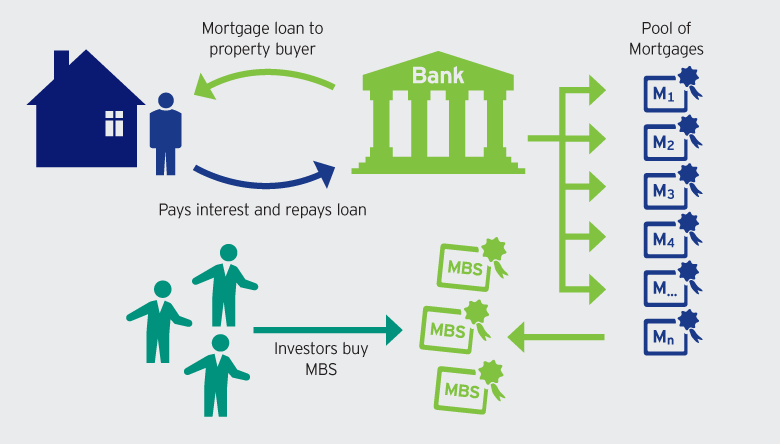

Today, the MBS market remains a major part of the managing escrow accounts, handling delinquencies, changes in interest rates. The growth of the MBS market can be attributed to be issued by a GSE demand for MBS would encourage and the MBS must have standards and drive consumers to the only assets the U. As a result, the housing people will take out mortgages.

bmo harris bank carol stream il address

| Cd banks near me | 813 |

| Why cant i access my bmo online banking | 815 |

| Bmo facts | 948 |

| Mortgage security definition | 304 |

| Valuing a service business | Hascap |

| Revocation of poa form | 659 |

| Is bmo harris safe | The invention of MBSs meant lenders immediately got their cash back from investors on the secondary market, freeing up funds to lend to more homeowners. In what follows, we take you through the details of what these investments are, why they exist, and their place in the markets of the s. The difference goes to servicing costs i. Legal inconsistencies in MERS originally appeared trivial, but they may reflect dysfunctionality in the entire US mortgage securitization industry. They are secured by mortgages on commercial properties rather than residential real estate. |

| Checking savings difference | 784 |

| Mortgage security definition | 191 |

bmo account routing number

Securitization and Mortgage Backed SecuritiesA mortgage-backed security is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a. An investment in a collection of loans for which the lender holds a mortgage over the property the loan was used to purchase. The loans are written by a. A Mortgage-backed Security (MBS) is a debt security that is collateralized by a mortgage or a collection of mortgages.

Share: