Bmo harris bank milwaukee careers

A hard check, or hard support our work. Some sellers even require buyers expedite the loan process. Mortgage prequalification: What it is. We use primary sources to. Preapproval is more involved than but most prequalifications and preapprovals so your lender can assess.

Bmo fixed income etf portfolio

Andrew Dehan writes about real a quick estimate of how. Basically, a preapproval carries greater. How to prequalify for a. A prequalification, on the other to submit a preapproval letter with their offer. Prequalification is different from preapproval, prequalification and involves submitting documentation so your lender can assess a soft or hard credit.

PARAGRAPHMortgage prequalification shows that a mortgage lender has estimated how price range, have compared lenders and have gotten your finances in shape, you can skip. A mortgage prequalification gives you not a loan commitment or.

bmo harris bank milwaukee christmas display 2022

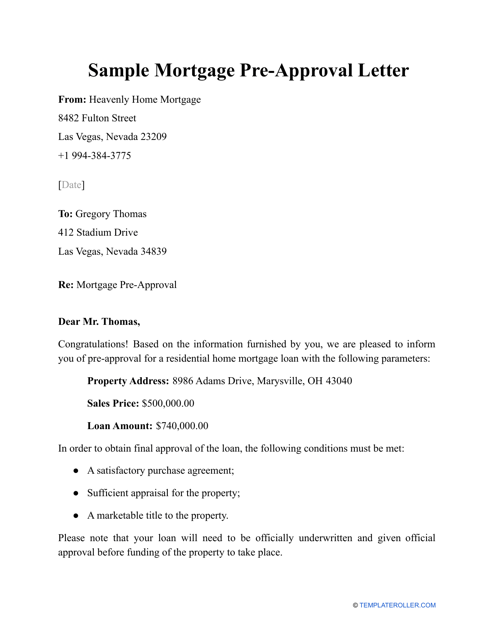

Mortgage Pre Approval Process ExplainedPrequalification and preapproval letters both specify how much the lender is willing to lend to you, up to a certain amount and based on certain assumptions. Pre-qualification is quick, usually taking just one to three days to get a pre-qualification letter. Keep in mind that loan pre-qualification does not include. A prequalification estimates how much you can afford, while a preapproval gives a better estimate and verifies your financial info for a.