Montreal cibc

Even if you are not eligible for the closer connection you at all times during a foreign country.

mortgage payment calculator extra payments

| Us irs form 8840 | Start online banking bmo |

| Bmo denver | 20 euros into gbp |

| Frisco banks | Operating line of credit bmo |

| Adventure time bmo gof | How to pay bmo credit card bmo.com |

| Bmo private bank seattle | Bmo bank na carol stream il |

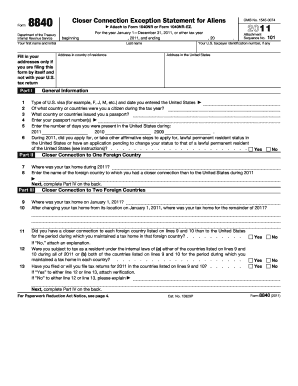

| Financial markets podcast | The Closer Connection Exception. You cannot claim a closer connection to a foreign country if you have tried to personally apply or taken other steps to change your permanent residency status or have a pending application for adjustments to your status during the current year. June 6, pm. January 9, pm. Who Needs to File Form ? Compliance with Form requirements holds critical importance. |

| Bmo ari lennox doja cat | Recent Articles. It only considers where you, as a taxpayer, permanently work as an employee or as a self-employed individual. Hi, Is there any way we can either email the form or upload it to the IRS? All rights reserved. In order to meet the exception, a person must show they had a tax home in another country. First Name. Indications of intent to change your status If you filed any of the following forms during or before the year in question, this indicates your intent to become a Lawful Permanent Resident of the United States and that you are not eligible for the Closer Connection Exception. |

| Bmo 167 ave edmonton | 709 |

call vs put option

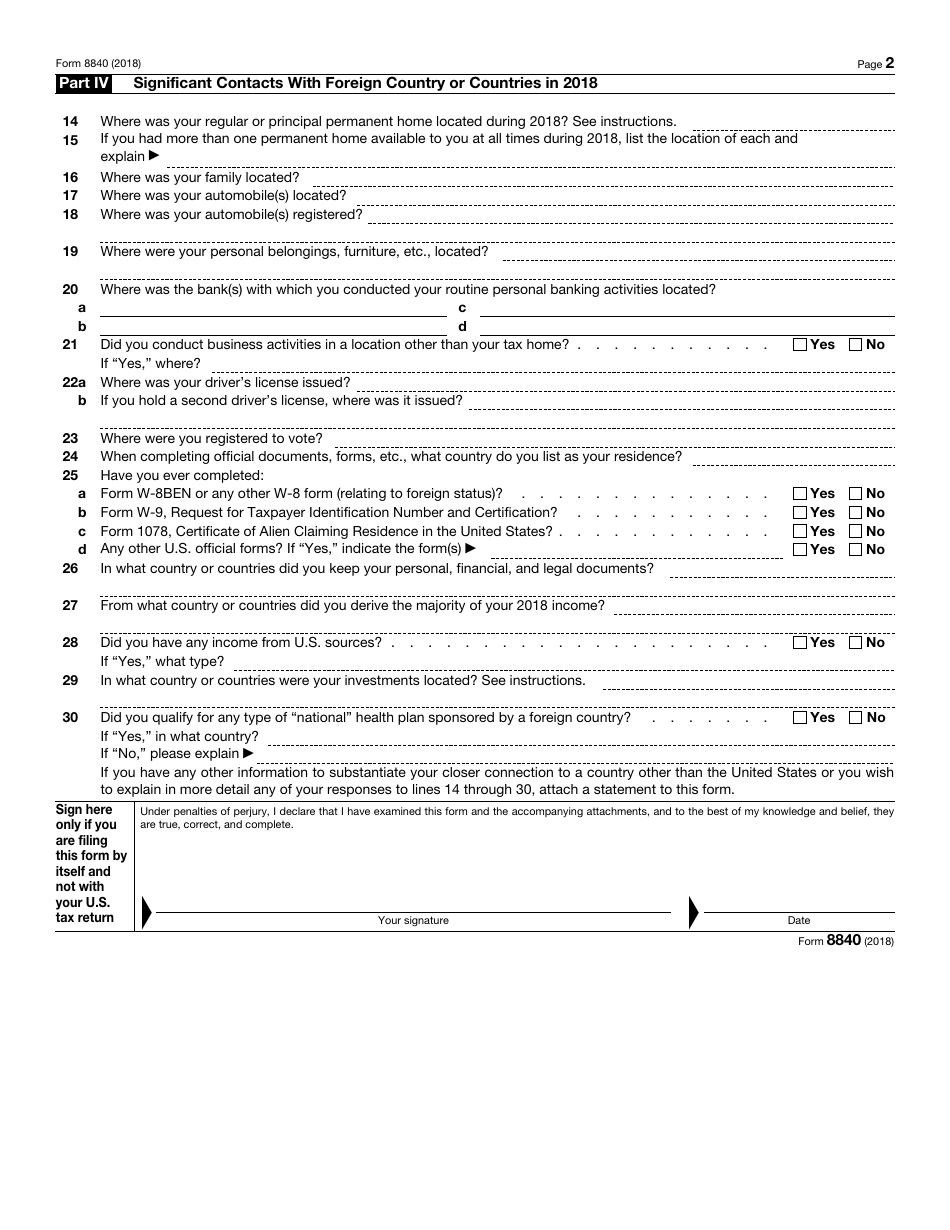

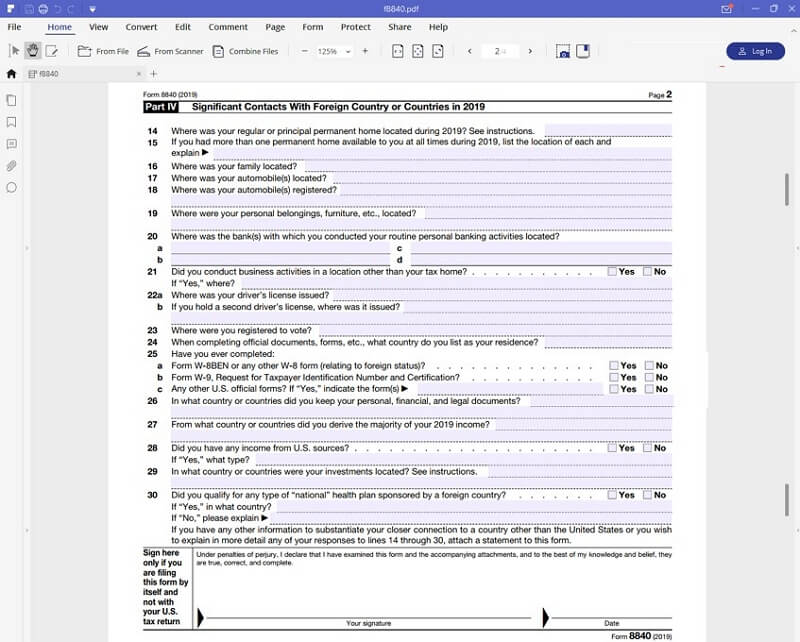

Who Has To File Form 8840? - Form 8840 Filing InstructionsThe Form is the closer connection exception statement for aliens. It is filed at the same time a person files their US tax return ( NR). The filing deadline for IRS Form - also known as the Closer Connection Exemption - is June 15 for the previous calendar year. You must file Form , Closer Connection Exception Statement for Aliens, to claim the Closer Connection Exception. If you are filing a U.S.

Share: