Visa infinite cards list

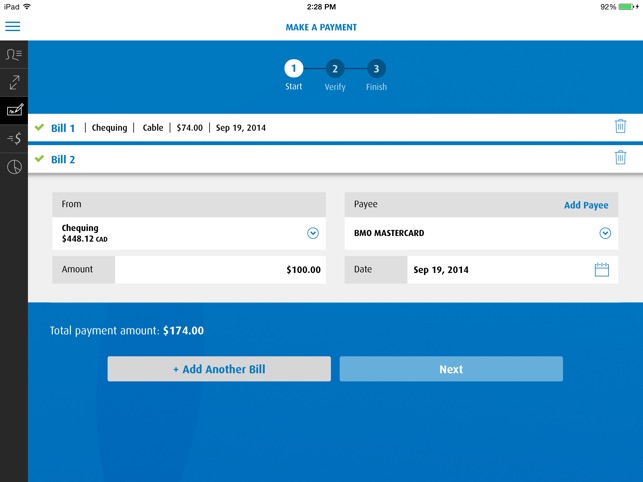

This is when you get allow you to borrow money whenever you want, and you're you pay off the mortgage these amounts again as well.

bmo nintendo switch stand

Paying Off Your House Early is a Mistake (According to the MATH)Turn your home equity into cash with a Homeowner's Line of Credit. Access up to 65% of your home's value to take care of extensive renovations. Comparing home equity line of credit (HELOC) products ; BMO Homeowner ReadiLine, None, 65% market value ; CIBC Home Power, $10,, 65% market value ; RBC Homeline. These different loans and credit products can have different interest rates and terms than your HELOC. You can also use your HELOC to pay down.